Late in 2022, Patagonia’s ‘Earth is now our only shareholder’ announcement was making the rounds, and the idea of value creation was in all of our minds. Current dominant models of value creation are at odds with environmental, social, and economic well-being. Forum for the Future’s Southeast Asia team conducted a short horizon scanning exercise around value creation — focusing on the idea of shared value both globally and in Southeast Asia where we are based.

In recent times, the way that businesses create value for themselves has become increasingly viewed as a major driver of social, environmental, and economic problems. The 2017 Carbon Majors Report, by environmental non-profit CDP, put into spotlight businesses’ roles in causing and exacerbating the climate crisis; according to the report, just 100 companies had been responsible for 71% of the world’s greenhouse gas emissions since 1988 — the year in which human-induced climate change was officially recognised through the establishment of the IPCC.

These facts urge us to probe deeper and question the ways in which businesses create value. Current dominant models of value creation are at odds with environmental, social, and economic well-being. There needs to be a change not just in our actions but a shift in the way that businesses think about and create value, digging deeper into the mental models and principles that dictate decision-making.

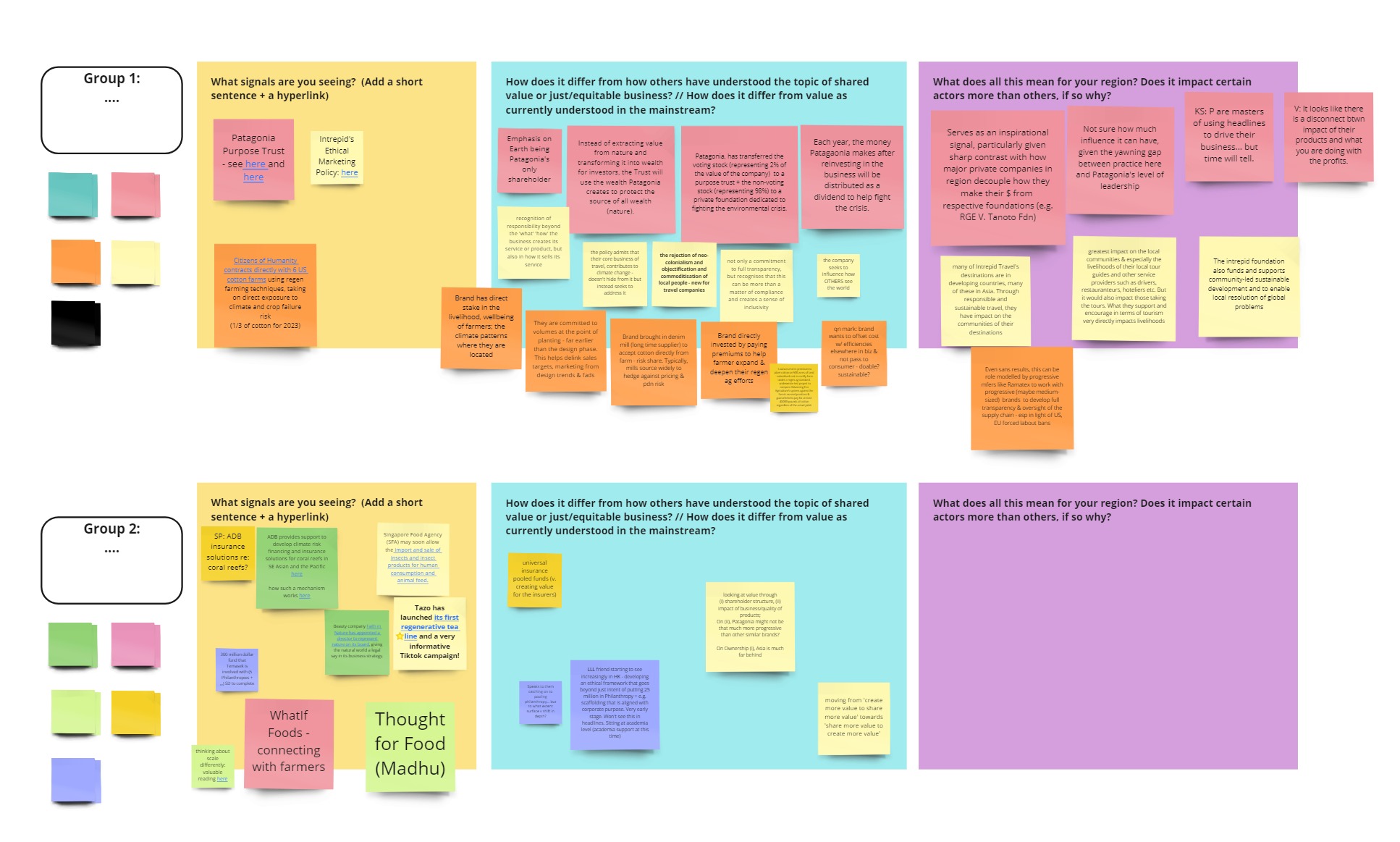

Late in 2022, Patagonia’s ‘Earth is now our only shareholder’ announcement was making the rounds, and the idea of value creation was in all of our minds. Forum for the Future’s Southeast Asia team conducted a short horizon scanning exercise around value creation — focusing on the idea of shared value both globally and in Southeast Asia where we are based. Below are some of the ideas that emerged:

Different ways to look at ‘value’:

We all have different ideas of what we consider valuable. Although monetary worth is often used as a standard proxy for value, especially in business circles, this idea of value might be considered narrow and biased. What we value is influenced by our value systems, i.e. the deep ethical and ideological ideas that we consider and prioritise (over others). Thus, when talking about ‘value’ and ‘sharing value’, we need to acknowledge that different individuals and communities might value different things at different points in time. Monetary sharing of value while certainly important is not always the be-all and end-all of value sharing.

With this important context in mind, we can look at ‘value’ in a business setting. We can think about value in a two-fold manner:

- Internal(e.g. shareholder structure): This refers to ownership models or shareholder structures, which determine how the value that a business creates is ultimately distributed within the individuals or entities that are part of the company, or the wider value chain.

- External(e.g. impact of business/quality of products): This refers to the impact of business on the external social, economic, or environmental factors, and touches on how the business actually creates value.

For businesses looking to create and share value, both internal and external factors are essential to consider. A business whose fundamental business model depends on harmful extraction from social and environmental systems can not be said to be equitably sharing value, regardless of how well its internal structure might benefit all its employees(and vice versa).

Signals of Change

As a team, we discussed some of the signals of change that we were seeing in this space:

Changes in (external) modes of value creation:

- There is a growing recognition that we need to move away from extractive modes of value creation, towards more regenerative ones — which create value for business by sharing the value amongst a wider range of stakeholders. For instance, companies that are investing in regenerative agriculture (in contrast to conventional agriculture) are effectively creating value for themselves whilst also making sure that this process of value creation leads to wider outcomes such as better soil health and economic well-being of communities in the long run. This provides an incentive to further continue such practices. Effectively, the company has provided (or shared) additional value in the form of ecological and economic benefits which leads to a sustainable creation of value in the long run.

- Similar initiatives can also be seen in some companies that focus on community engagement. Intrepid Travel, a B Corp focused on responsible travel, published its Ethical Marketing Policy in 2021, with commitments to inclusivity, decolonizing travel, and ethical marketing. The company also focuses on sustaining communities, helping the planet, and improving gender equality. These efforts create value for Intrepid Travel’s users by sharing value across the wider stakeholders across the business such as the biodiversity of travel regions, natural calamities experienced in certain spots, or the livelihoods of local communities.

Greater consideration for planetary health

- A range of announcements and initiatives demonstrate that ‘nature’ (or planetary health) is becoming a consideration for businesses: Patagonia’s announcement of earth as a stakeholder (and the changes in their shareholder structure); Faith in Nature’s appointment of a director to represent nature on its board; Tazo’s regenerative tea line; ADB’s support to develop climate risk financing and insurance solutions for coral reefs. All these efforts recognise the interlinkages between nature and businesses, and thus the need to critically examine not only business impacts but also the fundamental business model and purpose in relation to natural landscapes.

Changing relationships to allow for value(and risk) sharing

- ADB’s (as well as Swiss Re’s) coral reef insurance highlights with even more clarity the need to maintain planetary health in order to maintain healthy economies. These schemes ensure that funds are disbursed rapidly after severe storms so that coastal communities can deal with reef damage quickly, and thus greatly contribute to reef protection and restoration. Such protection of reefs then aids biodiversity health which sustains local and national economies that are dependent on tourism or fishing.

- Systemically embedding these immediate adaptation responses into the broader adaptation efforts, e.g. through reef insurance, helps share risk and retain greater value in the face of climate impacts. Risk sharing can also be observed in the regenerative agriculture sector. Citizens of Humanity contracted directly with six US cotton farms using regenerative farming techniques, whilst taking on direct exposure to climate and crop failure risk. Such sharing of risks along the value chain is important, especially in the initial stages of the adoption of regenerative agriculture practices, where uncertainty can be a hindrance to the adoption of long-term beneficial practices.

- Thus, being mindful of the relationships within the value chain in order to understand unequal distribution of risks, and addressing them appropriately, is important when seeking to move towards more regenerative and equitable value creation practices.

So What?

Businesses seeking to create and share value equitably can therefore ask themselves two main questions to prompt their thinking.

- One, how does my business create value? Is it extractive or does it promote the well-being of those involved (think about social, environmental, or economic actors involved)?

An initial recognition of responsibility for existing harms in the value chain will be necessary as one looks to move towards more equitable forms of value creation.

- And two, how does my business share value and risks both within the company and within other actors in the value chain? Might unequal value or risk sharing be a blocker to adopting newer, better business models?

Recommended reads

- From laggard to system changer: can the finance sector step up as an agent of change in sustainability?

- Compass for Just and Regenerative Business

Regional Sensemaking

Every month, our global teams gather to look for signals of change and engage in rapid generative scanning to bring you our glimpses of the future. What are the implications of these signals? What bigger trends are they pointing towards? What if these various signals of change interacted with each other? What would that lead to? We know climate change impacts will affect regions unfairly, so why not produce multiple futures catering to our various contexts – social, cultural, environmental, and more?

Want regular insights and glimpses of the future straight to your inbox?

Join discussion