In the latest of our Future of Sustainability: Looking Back to Go Forward series, Emilie Goodall, Forum for the Future Affiliate, and Caroline Ashley, Forum for the Future’s Global Programmes Director, explore whether and how finance sector players can step up as agents of system change. As innovations start to stretch ambition well beyond the uptake of ESG, Emilie and Caroline consider what trends we’re seeing and use systems change thinking to assess progress and potential.

Note: The authors recognise that this opinion piece is necessarily partial – not all trends or dynamism in the finance sector are represented. They also acknowledge that these insights are reflective of their own position and biases, based in the global north, and working as part of an international sustainability organisation, originally founded in the UK.

The finance sector has long been a laggard in addressing sustainability. Recently that seems to have changed. Environmental, social and governance (ESG) investment is booming. Net zero alliances have been established for asset owners, managers, banks, insurers and advisers. But this is no panacea. If the huge power of financial organisations is to be harnessed to drive a different future, there is so much more to address than the uptake of ESG.

The key opportunity for finance sector players is in realising the potential of investing not just in a business but for the wider health of a system.

This may sound ambitious, but a window of opportunity has opened. The concept of ‘finance is neutral’ has been debunked. The climate crisis has provoked recognition that finance has a role in driving carbon emissions – and reductions – and a responsibility to act. In ‘systems speak’, agency is now recognised. The principle that finance is a shaper of change can now be applied to more than just GHG emissions.

Beyond ESG

Most conversations on sustainability within finance focus on uptake of ESG, a term used as shorthand for the wide range of environmental, social and governance ‘nonfinancial factors’ that could affect financial returns and should be integrated into financial decision-making. ESG assets are forecast to hit one third of global assets under management (AUM) by 2025, or $53 trillion. Europe is leading the way, with the US catching up. Japan and other Asian nations are anticipated to follow.

Part of ESG’s rapid growth is down to its success at selling itself as a way to mitigate (financial) risk and/or boost (financial) returns. And therein lies the limitation of ESG in driving system change: it serves rather than shifts the existing goals of the system.

ESG in public markets is often about rearranging portfolios. It affects stock holdings, without changing the fundamentals of the economy. Another major problem in this ESG-era is the neglected ‘S’. World Benchmarking Alliance data reveals just 1% of large businesses screened meet even basic social standards. There is a lack of acknowledged responsibility for human rights abuses through the value chain back to financiers.

So ESG is mainstreaming, but it’s not changing the system. What could? At the ‘niche,’ we identify three dynamic trends:

- Impact investing intentionally seeks out – and measures – net positive impact, such as contribution to the SDGs.

This is a fractional sub-set of ESG or responsible investing, defined by its active focus on the ‘delta’ or the added environmental and social value delivered by financing selected businesses. Various impact investing ‘tribes’ range from the green finance movement and hyper-local social investors to multi-million development finance initiatives engaging in blended finance. - Judging ‘good investment’ not on whether it is better than before, but on whether it keeps the economy within necessary thresholds.

The Science Based Targets initiative and 2DII are the most well-known technical approaches to applying thresholds to financial institutions’so far, but others are emerging in what is a contested discipline that reflects a critical principle of how to judge – and compare – performance, with r3.0 and Kate Raworth’s Doughnut Economics leading the charge. - Influencing the rules of the game.

While corporate lobbying to protect vested interests continues, we are also seeing finance actors actively calling for better sustainability-driven regulation. COP26 saw a number of financial players urging governments to both change the incentives for private sector behaviour and regulate it more tightly. Elsewhere, investors have vocalised their frustration at the potential watering down of the EU green taxonomy, and delays to the social taxonomy.

These three trends feed into a fourth shift for financiers as agents of change, and perhaps most significant: Acting to influence change at a system level by intentionally investing for the health of the economy, environment and society.

System-level investing is a term coined by The Investment Integration Project (TIIP), to define ‘the intentional consideration by investors of the bigger-picture environmental, social or financial system context of their security selection and portfolio construction decisions’. It is the difference between assessing the sustainability risks and impacts of individual assets or enterprises, and seeking to assess the risks and impacts of the market on such issues. And, critically, it’s about using this assessment to influence change, recognising it as central to, rather than in conflict with, enhancing long-term investment returns. System-level investing can use any or all of the three trends above. Indeed, all three are likely needed to drive positive impact.

Examples of what this looks like include:

- Investors pressuring firms to mitigate behaviour that, although profitable for the individual company, damages the market overall.

Consider Shareholder Commons’ Fox News resolution, in which shareholders were asked to vote in support of insisting Fox stop spreading disinformation about climate and vaccinations. The argument is that the majority of Fox’s shareholders hold shares across the wider market and, therefore, benefit from a well-functioning market. If a company spreading disinformation undermines that market functioning, the result is a bad outcome for such shareholders, even if lucrative for the individual company. - Engaging with standard setters to inform international standards, in order to adopt these into their own investment processes.

Consider the Coalition for an International Platform for Climate Finance, led by Aviva Investors, which is calling for a new financial architecture to leverage public and private finance into the carbon transition. - Revisiting the responsibility investors have in multiple jurisdictions to maintain ‘market integrity’.

There is potential to widen responsibility from its current focus on matters such as bribery and corruption, and to incorporate wider sustainability matters that threaten market integrity.

System-level investing could also be seen in investor actions to transition other systems (such as food or energy). In the US, diverse investors are actively shaping the transition to regenerative agriculture. Akiptan, for example, is a Community Development Finance Institution of the Sioux community, with a mission to ‘transform Native agriculture and food economies’ by delivering creative capital, leading paradigm changes, and enhancing producer prosperity.

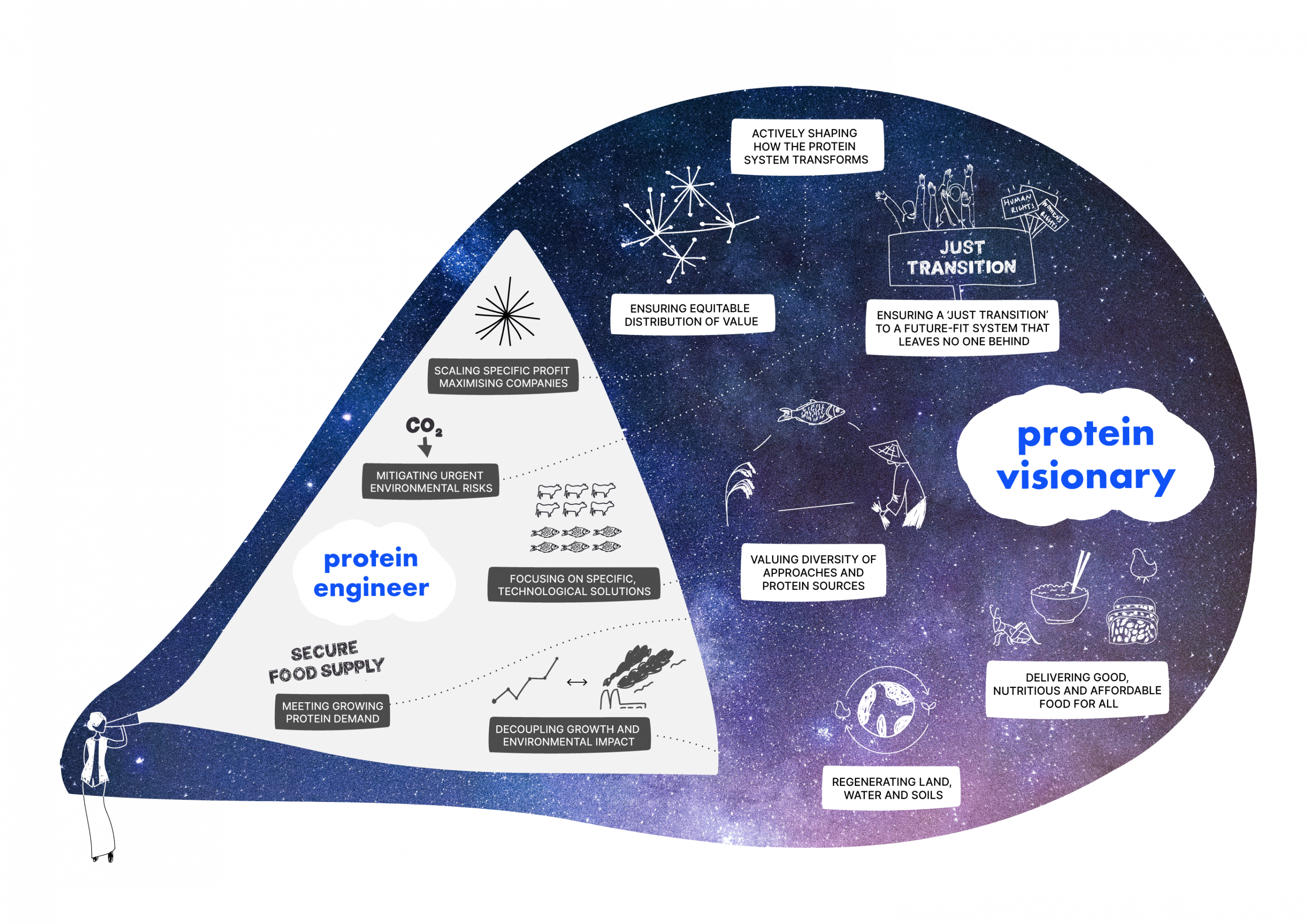

In South East Asia, finance players are joining with Forum for the Future and other protein actors to explore the shift from ‘protein engineering’ to a ‘protein visionary’ approach that addresses equity and sustainability in the entire protein system, from diverse production to affordable nutrition.

Protein South East Asia project

Promising, but…

While these examples are promising, it is still rare that financial players taking a systematic agent of change approach.

Our conclusion? If these trends are to truly shape a different future, there needs to be a more fundamental remodelling of the financial architecture. None of the trends listed above are (yet) truly challenging the fact that only a fraction of the world’s population is served by global capital flows – the same capital flows within which all of the above trends operate.

To quote Gillian Marcelle, a blended finance advisor experienced in economic development and capital mobilisation, there must now be a “widening of the solutions space” across all of the trends cited above.

It cannot be about extending an unsustainable financial infrastructure, moulded by a handful of countries, to the rest of the world.

Other voices and ideas must be incorporated. And more substantially, we need different models and mechanisms capable of acting as alternatives to – rather than niches within – the mainstream.

Watch this space

This piece concludes Part Three of the Future of Sustainability series. Join us in March 2022 as we begin Part Four – as we take all that we’ve heard to present key takeaways for the sustainability movement and explore what’s coming…

About the Future of Sustainability: Looking Back to Go Forward

Produced by international sustainability non-profit, Forum for the Future, the Future of Sustainability: Looking Back to Go Forward is a unique opinion and commentary series set to explore lessons learned from the last 25 years in the sustainability movement and what they mean for the future.

Based on new and exclusive insights from diverse voices across the sustainability movement, we’ll examine where we have succeeded and where we have failed in creating real change. We’ll consider how the world is responding to today’s multifaceted challenges and opportunities, and what pivots might be needed if we’re to deliver at scale and pace. Lastly, we’ll look forward – exploring how we can reframe the goals of the system, reset our ambition, and encourage the adoption of new mindsets and approaches critical to creating what’s really needed: a truly just and regenerative future.

With thanks to our partners

Looking Back to Go Forward was made possible thanks to the generous support from our partners: Laudes Foundation, GSK Consumer Healthcare, Target, M&S, Capgemini, Bupa, 3M, the Cosmetic Toiletry & Perfumery Association (CTPA), Burberry, Olam Food Ingredients, and in particular our headline sponsor, SC Johnson

Join discussion