There is no argument that the market for “Green” and ESG finance products has grown dramatically in the past year. (For example, green bonds issuance is almost triple what it was from the previous year.)

This is in combination with increasing calls and action for regulated reporting of environmental risks and impacts, including from President Joe Biden and Chancellor of the Exchequer in the UK, Rishi Sunak.

This is pushing both incumbents and new market actors to move towards ESG and Green products

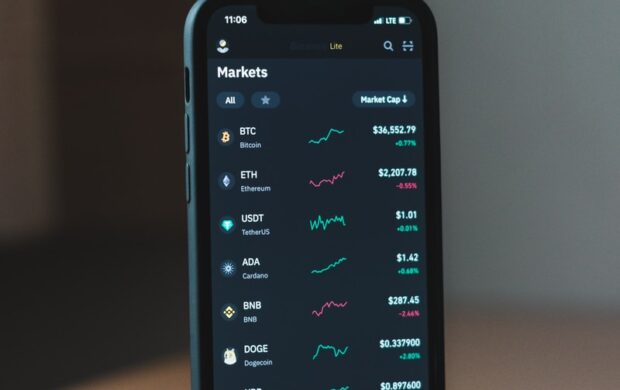

For Bitcoin and the world of cryptocurrencies, ESG considerations are operating in different ways, including those working to “sell coins whose transactions are verified on the blockchain by computers supposedly powered only by renewable energy.”

Another example is banks looking to buy bitcoins that can “fulfill increasing demand for ESG compliance.” Sheldon Bennett, chief executive officer of crypto miner DMG Blockchain Solutions Inc.

So what?

Beyond the increasing attention of the environmental impact of mining for and trading with cryptocurrencies, this indicates that there is such an intense push for ESG finance products that it is breeding innovation. Bitcoin’s energy needs for mining have already become so gargantuan that mining is causing blackouts in some countries, and Bitcoin carbon emissions in China alone already exceed the total emissions of the Czech Republic and Qatar combined. Could ESG bring much needed change?

A Green Bitcoin is long overdue! But just shifting mining to use renewable energy feels more like a sticking plaster than a real solution – the problem is that the mining process is fundamentally designed to be an ever increasing energy hog. A shift away from mining to ‘proof of stake’ could potentially solve this – and looks like it might happen for other important cryptocurrencies like Ethereum by the end of this year. But within Bitcoin communities such a move is very controversial becuse it will completely disrupt the current power balances – away from large miners and towards large exchanges. And given the distributed nature of Bitcoin, a lot of miners will need to agree to it for it to happen. Will be interesting to see if ESG brings enough pressure here for such a fundamental (and needed) switch to happen…..