Global Economic Shifts

The global financial system currently misallocates resources at extraordinary scale due to an economic model which is focused on short-term profits and growth, and which ignores much social and environmental value. This systemic misallocation exacerbates inequalities of wealth and power. And it drives investment into activities that overshoot planetary limits, pushing us towards climate and biosphere breakdown.

Read more

Current Trajectory

However COVID-19 has taken us far into uncharted waters, with an unprecedented level of economic crisis. Simultaneously, this provides an opening for potential deep economic reform, rather than retrenching the status quo.

Recovery from the devastating impacts of the pandemic has been branded by UN Deputy Secretary-General Amina Mohammed as a “once in a century opportunity to shift the economic paradigm towards more inclusive, carbon neutral and climate-resilient development”. The EU has led the response to this call by approving the biggest green stimulus in history. The choices we make in the next 6-18 months are critical and will have a ripple effect over shaping the next 10 to 100 years.

The recent wave of net-zero ambitions announced by major oil and gas conglomerates potentially heralds an important shift. Analysts nonetheless raise concerns over the viability of sustained reductions, in light of persisting capital commitments across the industry to develop new oil and gas. Similarly, while more than 40 governments worldwide have adopted some form of price on carbon, most countries have found it politically difficult to set prices that can incentivise truly significant reductions.

Meanwhile, blended finance – which draws on public or philanthropic money to reduce private sector risk – is still struggling to take off. The implications are stark, given its role in bridging the financing gap to support implementation of the SDGs in developing countries.

Implications

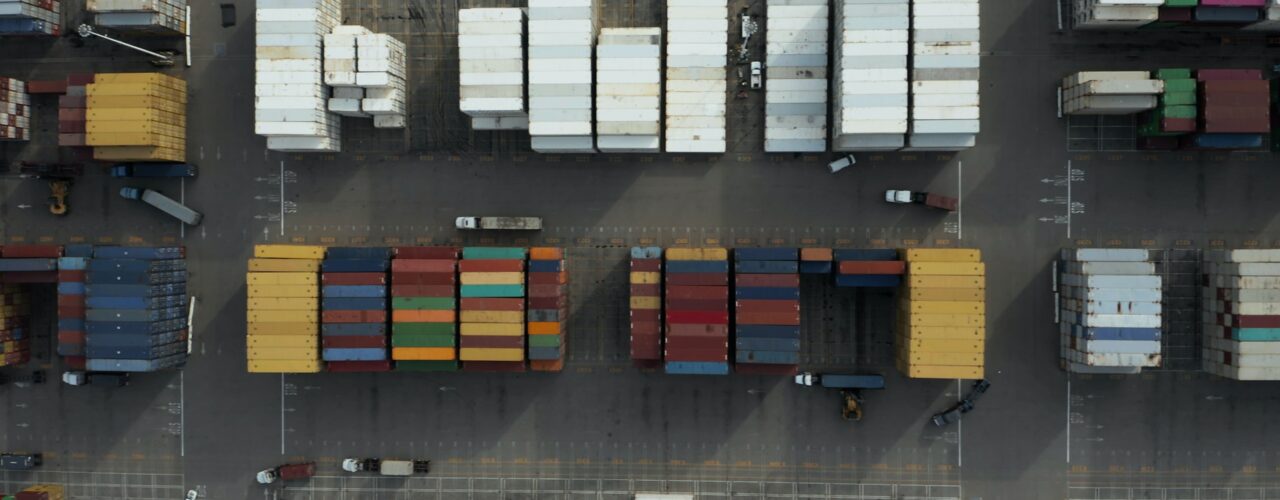

These mixed signals highlight the groaning tension between the urgent need for future-fit strategies and the deeply entrenched imperatives upon which the global economy has been predicated. How can we harness the $20 trillion in government stimulus packages in tipping the balance, and in ensuring a timely and equitable energy transition? And how can national policies and multilateral collaborations play a more effective role in creating new incentives? And as COVID-19 exposes the vulnerability of our global supply chains, to what extent are these policies equipped to enhance the resilience and support the greening of value chains?

Supporting evidence

- By April 2020, all G20 nations had signed sizeable fiscal rescue measures into law, earmarking a total of over US$7.3 trillion in spending. A review of 300 related policies revealed that 4% of policies are ‘green’, with potential to reduce long-run GHG emissions; 4% are likely to increase net GHG emissions beyond the base case; and 92% maintain the status quo.

- Relatedly, the current crisis is said to be putting climate finance largely on hold, as developed countries seek to save their own economies.

- In August, the Bank of England faced pressure to revise its pandemic rescue programme, after its stated priorities to reduce emissions were shown to be at odds with the central bank’s on-going subsidies to the most polluting sectors through its 20 billion GBP Corporate Bond Purchase Scheme.

- This is despite more than 200 leading UK businesses, investors and business networks, including Lloyds Bank, Asda, Siemens, Aviva, Sky, Mitsubishi and Signify calling on the UK Government in June to deliver a Covid-19 recovery plan that builds back a more inclusive, stronger and more resilient economy.

- Against this backdrop, big investors trial ‘net zero’ tools to decarbonise their portfolios as Bloomberg joins the ranks of ISS, Moody’s and MSCI in launching its own in-house ESG scores for investors, questions remain over how we can more fully harness the potential of finance flows to accelerate the transition to a green economy. See Missing the bigger picture? How a coal giant scored better on ESG than a renewables firm (and made the FTSE4Good)

- Meanwhile, UNDP champions the greening of value chains as a pathway to secure a “double-win” – i.e. diversifying exports, while promoting economies that are less carbon-intensive.

Join discussion